Changing a debit card PIN is typically a routine procedure at most banks, often with multiple methods available for your convenience. If you’ve lost your card or suspect it was stolen, consider contacting your bank for next steps to help secure your personal information. Knowing your current PIN will likely make your experience more straightforward, but isn't always needed if you can provide identification, like a government-issued photo ID. In personīank tellers can usually help you reset your debit card PIN. Once you’re logged in, you may see additional options in the menu that lead to a page where you can set up a new number. To take advantage of this method, you need to know your current PIN. Some banks allow customers to change their debit card PIN at an ATM. For security reasons, they may need to mail you a new PIN to your address on file.

If you don’t know your PIN, however, you’ll probably need to speak with a customer representative. If you know your current PIN, you may be able to reset it through an automated menu. It’s usually possible to recover or reset your debit card PIN via the bank’s telephone helpline. This section is typically located online under security settings, personal settings or customer self-service. Many banks allow customers to change or reset their debit card PIN via their website or mobile app’s debit help center. Most banks offer several ways of doing so, though procedures will vary. If it becomes necessary to reset your PIN, it can usually be done in a few steps. Thankfully, changing a debit card PIN is typically not too complicated. Yes, there are ways to change your debit card PIN. You’ll probably still need to verify your account ownership and may be directed to reset the PIN for security reasons. You can also call a customer care representative, or find a local branch for help. If you’ve forgotten your debit card PIN, some banks may offer a way to retrieve it through their website or app. What happens if you forget your debit card PIN While technically true, it’s not entirely difficult to see how this phrasing became commonplace. Since “PIN” stands for Personal Identification Number, some people claim that saying “PIN number” is redundant. A fun fact about debit card “PIN numbers”

Do credit cards require a pin verification#

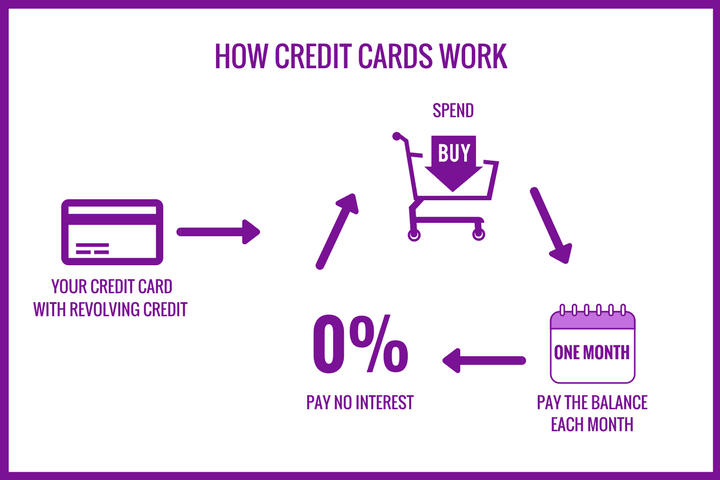

The CSC serves as an extra security verification when making transactions online or over the phone.

Do credit cards require a pin code#

Sometimes called the card verification value or card verification code (CVV or CVC, respectively), it's a three or four-digit number printed somewhere on your debit card. A debit card security code (CSC) is distinct from your PIN. Your debit card PIN is typically a four-digit number that lets you access your account.

There are several possible ways to combine numbers zero to nine into a four-digit combination, so it may be time to get creative! PIN vs. It may be tempting to go with something easy to remember like “1234,” but that’s also easy for others to guess. Typically, most debit card PINs are four digits long. The same basic process applies when viewing your account details at an Automated Teller Machine (ATM).

During transactions, card readers gather information from your debit card and send transactional details to the card issuer’s bank. Your debit card allows you to authorize payments and access your account details using your Personal Identification Number (PIN).

0 kommentar(er)

0 kommentar(er)